As we navigate the ever-changing landscape of the financial markets, staying informed about investment opportunities is crucial for making informed decisions. The S&P 500 SPY Equity ETF Trust, managed by State Street Global Advisors (SSGA), is one of the most popular and widely traded exchange-traded funds (ETFs) in the world. In this article, we will delve into the key highlights and insights from the

PDF fact sheet of the S&P 500 SPY Equity ETF Trust as of 12/31/2024, providing you with a comprehensive overview of this investment vehicle.

Introduction to the S&P 500 SPY Equity ETF Trust

The S&P 500 SPY Equity ETF Trust is designed to track the performance of the S&P 500 Index, which is composed of 500 leading U.S. companies across various sectors. This ETF offers investors a diversified portfolio of stocks, aiming to replicate the performance of the underlying index. With its inception in 1993, the SPY ETF has become a benchmark for U.S. equity market performance.

Key Highlights from the Fact Sheet

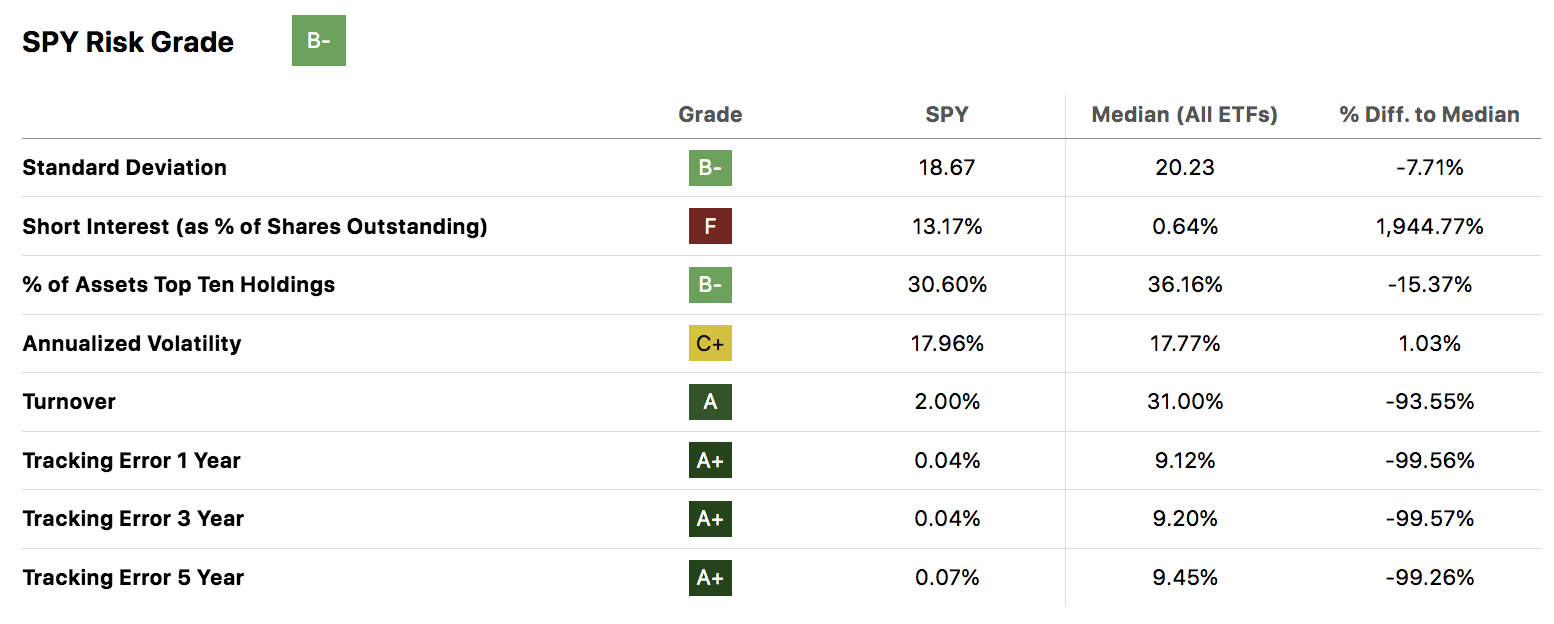

The fact sheet as of 12/31/2024 provides valuable insights into the ETF's performance, composition, and other essential metrics. Some of the key highlights include:

Net Assets: The total net assets of the SPY ETF stood at approximately $373 billion, indicating its massive size and investor interest.

Number of Holdings: The ETF holds 505 stocks, closely tracking the S&P 500 Index components.

Top Holdings: The top 10 holdings account for around 27% of the total portfolio, with Apple Inc., Microsoft Corporation, and Amazon.com Inc. being the top three constituents.

Sector Breakdown: The ETF has a significant allocation to the Information Technology sector (27.4%), followed by Healthcare (13.4%), and Financials (12.2%).

Performance: The SPY ETF has delivered a 1-year return of 10.2% and a 5-year return of 14.1%, demonstrating its long-term growth potential.

Benefits of Investing in the S&P 500 SPY Equity ETF Trust

Investing in the S&P 500 SPY Equity ETF Trust offers several benefits, including:

Diversification: By tracking the S&P 500 Index, the ETF provides exposure to a broad range of U.S. companies, reducing portfolio risk.

Convenience: The SPY ETF offers a single investment vehicle for accessing the U.S. equity market, making it an attractive option for investors seeking simplicity.

Transparency: The ETF's holdings and performance are disclosed regularly, ensuring investors have access to up-to-date information.

The S&P 500 SPY Equity ETF Trust is a popular investment vehicle that offers a diversified portfolio of U.S. stocks, tracking the performance of the S&P 500 Index. The fact sheet as of 12/31/2024 provides valuable insights into the ETF's composition, performance, and other key metrics. By understanding the benefits and characteristics of this ETF, investors can make informed decisions about their investment portfolios. Whether you are a seasoned investor or just starting to explore the world of ETFs, the S&P 500 SPY Equity ETF Trust is definitely worth considering.

Note: The information contained in this article is for general information purposes only and should not be considered as investment advice. It is essential to consult with a financial advisor or conduct your own research before making any investment decisions.

:max_bytes(150000):strip_icc()/SPDRSPY-8ba1fb8c8a4948eab6b05eac8af91574.jpg)